A new report from the National Bank of Canada is not super reassuring about becoming a homeowner in Vancouver, to say the least. If you’re curious about how long you’ll need to save to own a home in the city, read on. If you’d rather not see some crazy numbers, then here’s an unrelated article about the McBarge.

First off, some ground rules about it. The report uses the latest data for Vancouver’s median household income, which is currently $78,849. Then, they’ve got two categories for dwellings- condo and ‘non-condo’, which includes homes as well as things like townhouses.

Related Posts:

A juicy new realty show will follow luxury realtors in Vancouver and Richmond

One of Canada’s most iconic homes is back on the market

Ok, now on to the good stuff. The average price of a condo in Vancouver is marked around $630,000 while a non-condo is a whopping $1,300,000. So, assuming your average household is making Vancouver’s median income and is saving 10% a month, it would take 58 months and 408 months respectively just to afford the down payments. And, that’s assuming prices don’t continue to climb.

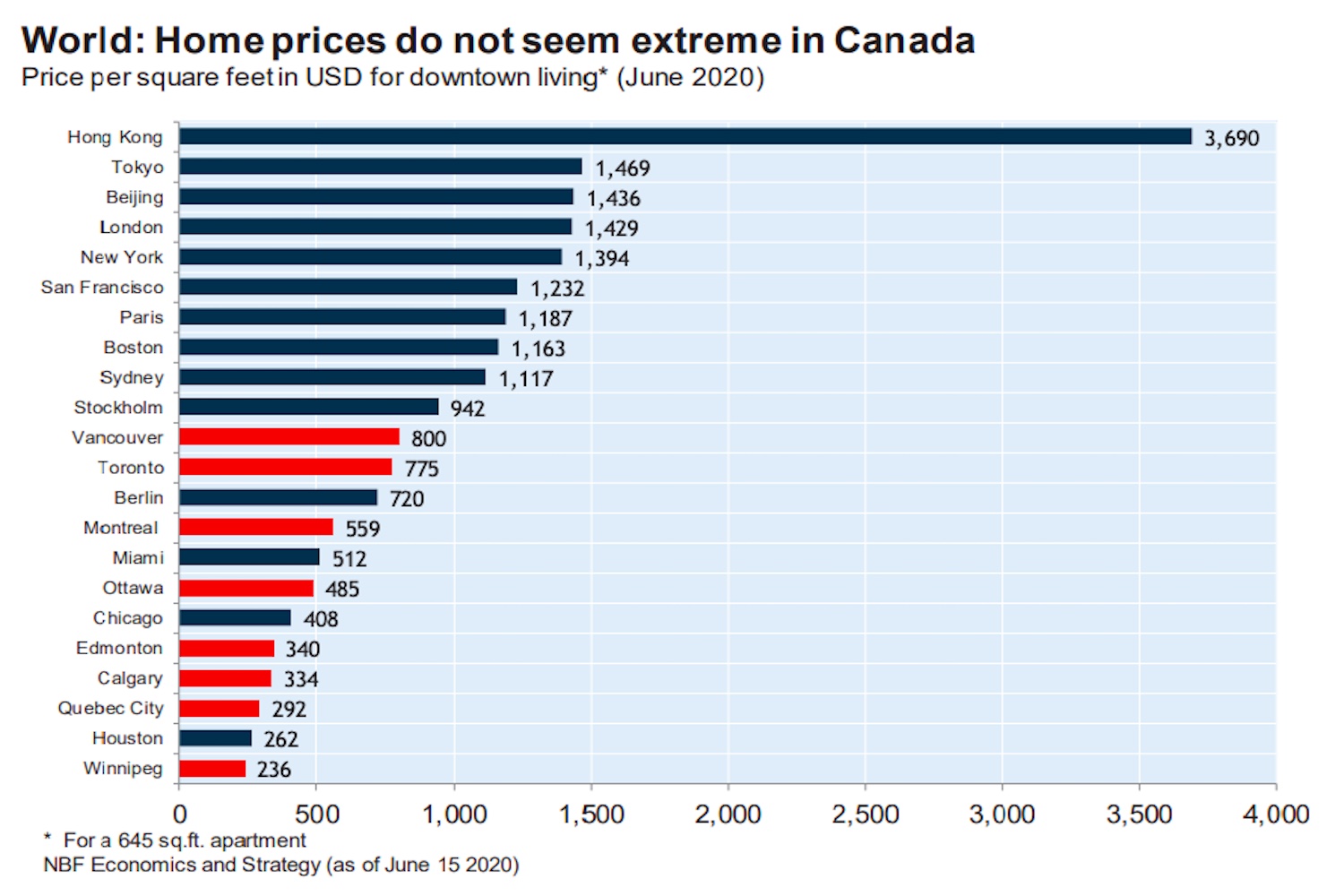

We know it’s not as bad as some other cities around the world, but 34 years just to get a down payment on a house? Somebody called Bong Joon-Ho, because we’ve got an idea for a Parasite offshoot.

You can check out the housing affordability report right here. Happy saving, folks!