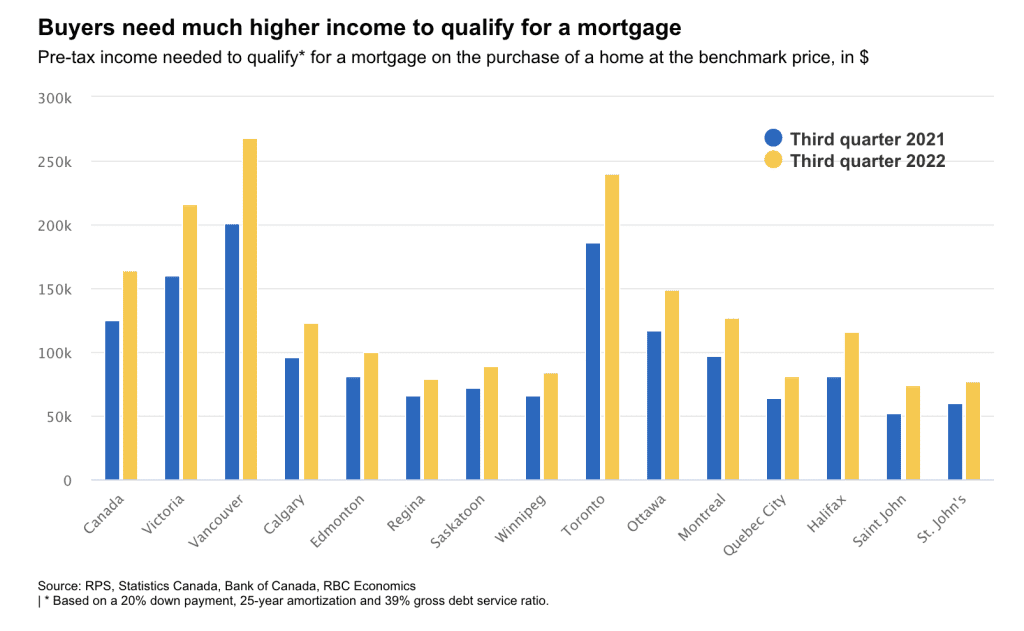

It has now become much more expensive to buy a home in Canada, thanks to inflation. If you’re one of many Canadians looking to buy a home this year, RBC has reported that interested buyers need a much higher income to qualify for a mortgage than ever before. And here’s what you need to know.

RBC Economics has reported that inflation has made it a lot harder for Canadians to buy a home in this country. Per the report, affordability is “overstretched” in Ontario and British Columbia, and other unlikely provinces are feeling the pressure too.

“It’s never been so unaffordable to buy a home in this country,” said Robert Hogue for RBC Economics. “Further interest rate increases propelled RBC’s aggregate measures to yet new record highs nationally and in Victoria, Vancouver, Toronto, Ottawa, and Halifax in the third quarter.”

Just look at 2021! At the time, in order to qualify for a mortgage on an average price of a Vancouver home, you needed an income of a minimum $200,000. The number has now skyrocketed to 34%, about $268,000. And in the Toronto area, where it was about $186,000, is now about $240,000, seeing a 29% increase.

Recent Posts:

The top 10 LGBTQ+ friendly cities in Canada with the best quality of life

Nobu will finally open in Toronto this year & here’s what it will look like

Here’s a breakdown of how much annual income is required to purchase a home per city in each province:

British Columbia

Buyers in Victoria need at least $216,000 to qualify (215,876) and buyers in Vancouver need about $268,000 (267,907).

Alberta

Calgary’s income numbers hit the $123,000 benchmark (123,340) and Edmonton’s hits about $100,000 (99,892).

Saskatchewan

Buyers in Regina need an annual income of about $80,000 and Saskatoon at about $90,000 ($79,387 and $89,304, respectively)

Manitoba

Buying in Winnipeg? You’ll qualify for a mortgage if you make about $85,000 ($84,279).

Ontario

Toronto is looking at an annual income of $240,000 to qualify and Ottawa at $149,000 ($240,470 and $148,970, respectively)

Quebec

Montreal home buyers need an annual income of about $127,000 while those in Quebec City need about $80,000 ($127,477 and $80,894, respectively)

Eastern provinces

Saint John in New Brunswick is still the lowest among the markets with an annual income of about $74,000, Halifax at about $116,000, and St. John’s in Newfoundland and Labrador at about $77,000.

According to RBC, the average annual income in Canada needed to qualify for a mortgage is $164,101.

Though not all hope is lost, RBC Economics predicts that the national benchmark price will fall 14% from the early 2022 peak, “providing significant scope to lower ownership costs once interest rates stabilize.”

Fingers crossed!