Purchasing a home in Toronto is almost an unattainable dream for some. So much so that renting is our only option and for others, possibly the best option. But have you ever wondered how much you’ve spent on rent that could’ve gone toward a down payment instead? – you’re not alone.

Real estate website, Zoocasa conducted a study on 35 of Toronto’s neighbourhoods and compared the average condo lease rate with sold prices.

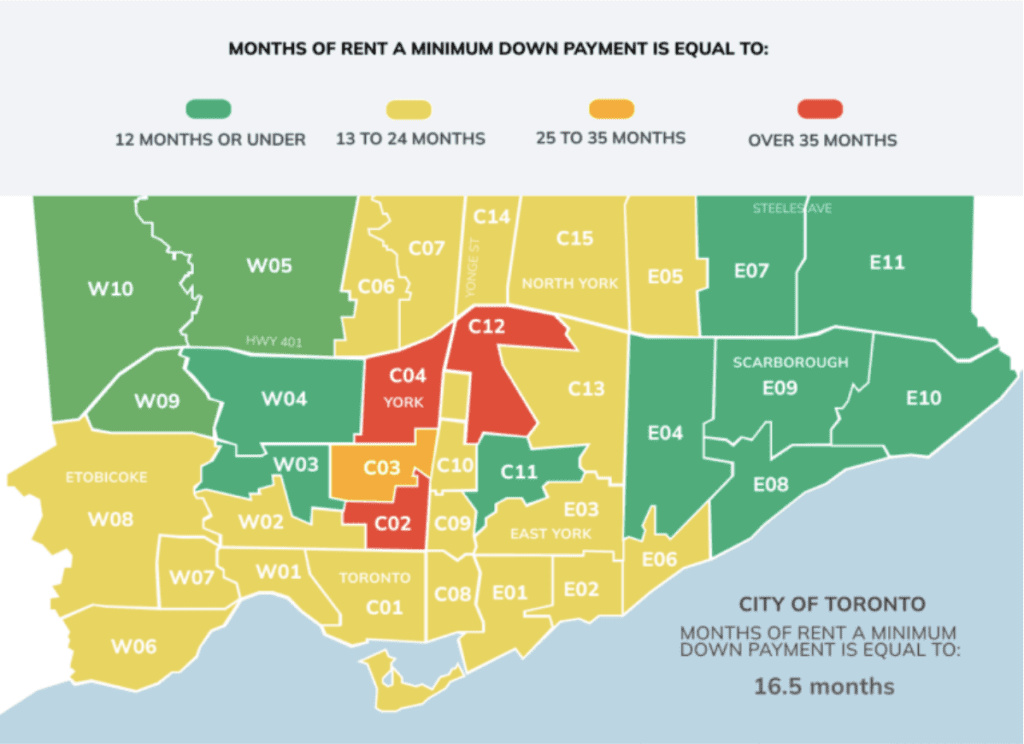

According to the site, they calculated the minimum down payment that is required to purchase the average condo in each neighbourhood, and the number of months of rent that would be equal to the down payment amount.

Recent Posts:

These cities have been ranked the best in Canada for students

Here are the best neighbourhoods for foodies in Toronto

Well, they found that in 12 out of 35 neighbourhoods in Toronto, it would take 12 months or less to save for what would be considered the minimum condo down payment.

The neighbourhoods include Scarborough Village, Yorkdale-Glen Park Weston, West Hill, Rouge, Thorncliffe Park, and Black Creek. And as you creep towards downtown Toronto, the minimum down payment amount increases, with about 19 or so neighbourhoods in the 13 to 24 months range.

Only one of the neighbourhoods is in the 25 to 35-month range – Forest Hill, Oakwood Village.

And three neighbourhoods are in the over 35 months mark – Bedford Park-Nortown, Lawrence Park, Forest Hill North, York Mills, Bridle Path, Hoggs Hollow and Yorkville, Annex, Summerhill.

You can check out the map below: