A new ranking is out, analyzing how cities in Canada compare when it comes to housing affordability and supply after they undergo processes, approvals, and charges.

The Canadian Home Builders’ Association has released its 2022 Municipal Benchmarking Study and it examined 21 Canadian municipalities through three categories.

Municipal planning approval processes, municipal charges imposed on new development, and municipal approval timelines were reviewed to see whether they help or hurt the development of new home construction.

“This report is intended to support the important conversation with all levels of government, but particularly with municipal governments, on the efficient delivery of much-needed new housing supply, including the impact that inefficiencies and taxes have on housing affordability, which is already a major challenge across the country,” said CHBA CEO Kevin Lee.

Recent Posts:

A new Asian fusion restaurant is opening in Vancouver & here’s what we know

There’s a hair freezing competition in Canada & it’s the largest in the world

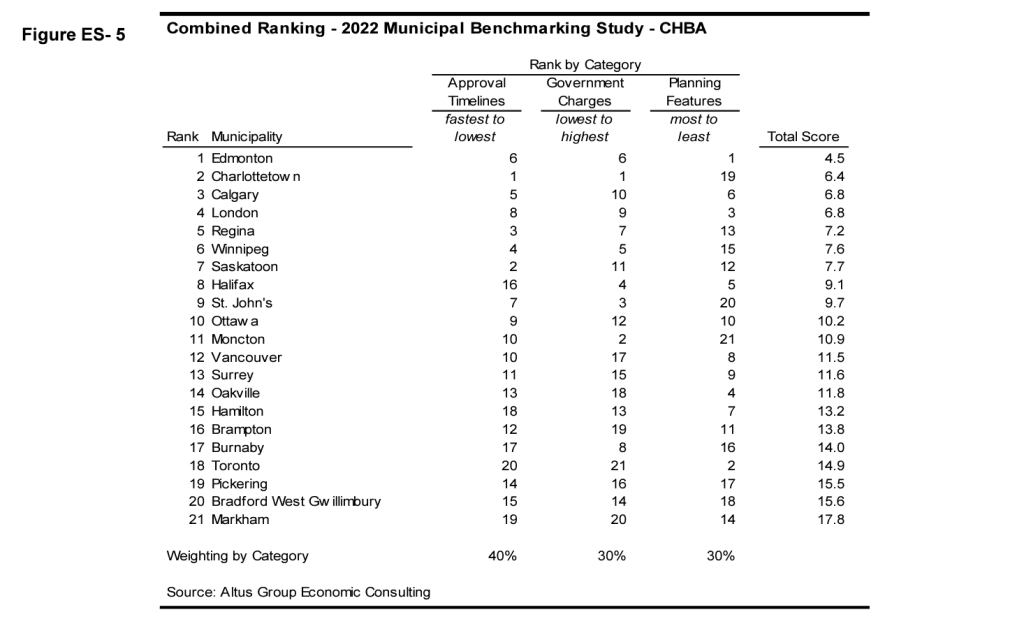

After finalizing the results, Edmonton, Charlottetown, and Calgary topped the list, in that respective order, with high scores in two of the three categories reviewed.

At the bottom of the barrel, you’ll find Toronto in 18th, Pickering in 19th, Bradford West in 20th, and Markham dead last in 21st place.

“The study shows significant variations in the approval timelines of municipalities, ranging from 3 months (Charlottetown) to 32 months (Toronto),” states the report. And according to the press release, CHBA’s 2020 Municipal Benchmarking Study compared to 2022 saw municipalities in Ontario have their timelines worsen, while others outside Ontario saw average timelines improve.

The average cost of government charges imposed by municipal governments on low-rise new housing development averages almost $62,000 per unit. Toronto saw charges over $189,000 per unit. And when it comes to high-rise new housing development averages were over $41,000 per unit while Vancouver saw average charges of over $125,000 per unit.

Overall, Canadians understand how expensive it can be to purchase a home, let alone how much they need to make in order to get approved for a mortgage. There’s no surprise here how financially difficult it can be to purchase a home in big cities like Toronto and Vancouver where municipal charges are the highest.

Maybe it’s time to look at cities that offer the best quality of life AND are much more affordable.