When it comes to buying a home it can be expensive to do it all on your own. If you’ve wondered how purchasing a home solo stacks up against purchasing with a partner in Canada, Point2homes has put together a breakdown of the time and cost to buy a home in Canada for singles vs couples.

Recent Posts:

Air Canada is launching new direct flights from Toronto to Osaka

Canada’s Ryan Reynolds drops trailer for ‘Deadpool & Wolverine’ during Super Bowl

According to Point2’s breakdown, The nationwide average to save enough for a starter home is now nearly four years for couples and close to 29 years for single people when looking at covering the difference between the home price and the mortgage, putting away 20% of their income.

Three to 75 years is how much time a buyer on a single income would need to cover the difference between the affordable bank loan and the starter home price in Canada’s 70 largest cities (using the latest population data from StatCan).

When compared to couples, they would need two to 27 years to save enough in the largest markets.

When looking at a starter home priced at $328,573, a single person with a median income of $40,788 annually would need 28 years and eight months to save whereas a couple with a median of $87,186 would need three years and nine months to save.

Top cities where it’s fastest for both singles & couples to save for their starter home

Looking to speed things up? 10 large cities across show both single homebuyers and couples looking for a home would need very similar periods to save enough to cover the amount left after calculating the maximum affordable mortgage loan.

The breakdown shows that Strathcona Count, Alberta is the fastest place to save for singles and couples with singles needing around three years and six months, and couples around one year and nine months.

Regina, Saskatchewan would take an individual three years and four months to save, compared to one year and nine months for couples.

At third fastest is Levis, Quebec where it would take a single person three years and seven months to save and a couple one year and ten months.

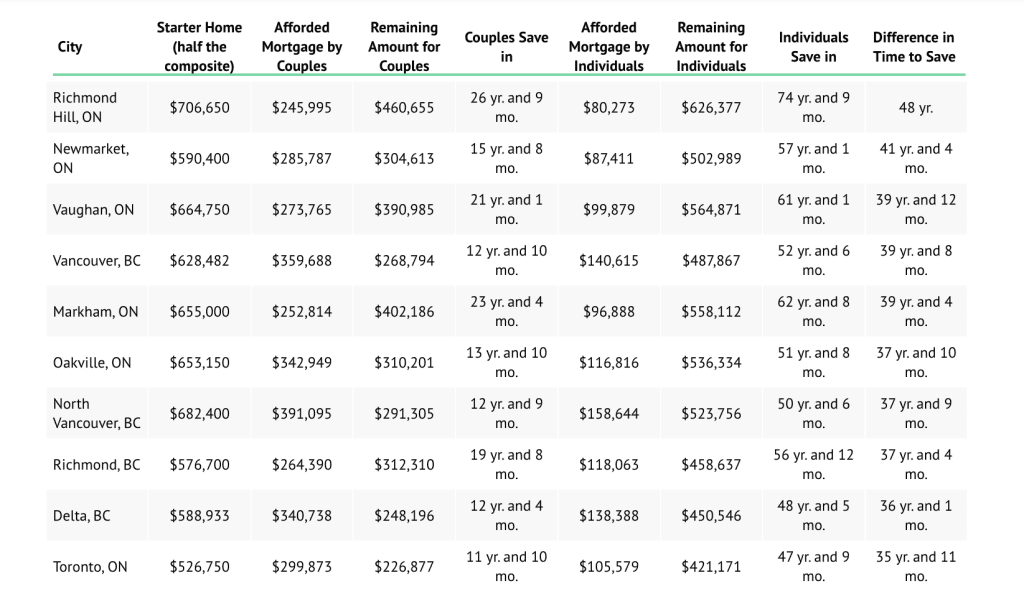

Cities with biggest gaps in saving timeframes for single vs. coupled homebuyers

If you’re single, maybe avoid these cities. Point2 has also put together the breakdown of Canadian cities with the biggest difference in time to save between singles and coupled households.

Richmond Hill, Ontario has the largest gap showing that a single person would need around 74 years and nine months to save for a starter home, whereas a couple would need 48 years.

Newmarket, also in Ontario, would take a single person 57 years and one month to save for, compared to 41 years and four months for a couple.

The third largest gap is in Vaughn, Ontario. Couples need 61 years and one month, couples would need 39 years and 12 months to save for a start home.

Whether you’re single or coupled up, will you try to buy a home in Canada soon?