Planning to buy your first home in Canada can certainly be a lengthy process, especially given the rising costs of living throughout the country. And without dual income, your options are even more limited. Thankfully, home prices have dropped in these regions over the past year, and a new report was just released that looks at how much it costs to buy a house with a single income in Canada.

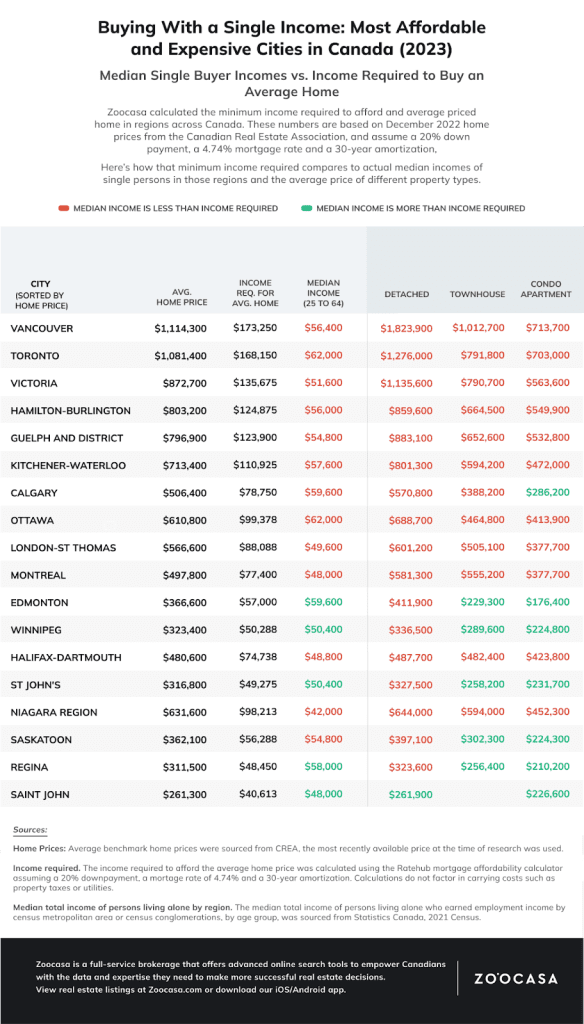

Zoocasa’s 2023 report dives into the most expensive and inexpensive places to live in the country when it comes to buying a home with a single income.

And for even greater insight, the report looks at which property types are ideal in each province for single-income buyers.

Related Posts:

Here’s how much money you need to live alone in 4 of Canada’s biggest cities

Here are the most affordable & expensive cities to buy a house in Canada

Most affordable cities

When it comes to the most affordable cities for single-income earners, there are five that top the list:

Regina, Saskatchewan

- Minimum annual income: $48,450

- Average home price: $311,500

Saint John, New Brunswick

- Minimum annual income: $40,613

- Average home price: $261,300

Edmonton, Alberta

- Minimum annual income: $57,000

- Average home price: $366,600

St. John’s, Newfoundland

- Minimum annual income: $49,275

- Average home price: $316,800

Winnipeg, Manitoba

- Minimum annual income: $50,288

- Average home price: $323,400

BC & Ontario

As for BC and Ontario, the average single-income buyer will likely run into some challenges, to put it lightly. The average home price in Vancouver currently requires a minimum annual income of $173,250 – which is more than triple the average income of $56,400 per year.

And things aren’t looking much better in Toronto, with an average annual income of $62,000 and a minimum required income of $173,250 to purchase a home.

Alberta

In terms of the most affordable property types, Zoocasa’s findings reveal that overall, detached homes are “a no-go,” and apartments and townhomes are the most solid options throughout the country for single-income earners.

This is especially true in Alberta. In Calgary, the average home price is $506,400, but the average apartment price is $286,200, which is well within reach of the average income of $59,600 per year.

And in Edmonton, the average apartment ($176,400) and townhouse ($229,300) are well within the affordability range of the average annual income of $59,600.

So all in all, if you’re looking to buy a home with a single income, your best chances are apartment-hunting in the prairies and on the east coast.

And with that… Happy Valentine’s Day…?