While the majority struggles to come up with a down payment, a new report shows that a fair portion of first-time homebuyers in Canada received an eye-popping amount from their parents last year. According to CIBC, an estimated $10B was gifted to potential home buyers from their parents in 2020. Yeah, crazy, we know.

First up- we really don’t like when reports are referenced but not linked (cough other media outlets cough), so you can check out the new report of homebuyers in Canada in full right here. Ok, with that out of the way, it’s time to unpack some downright crazy numbers.

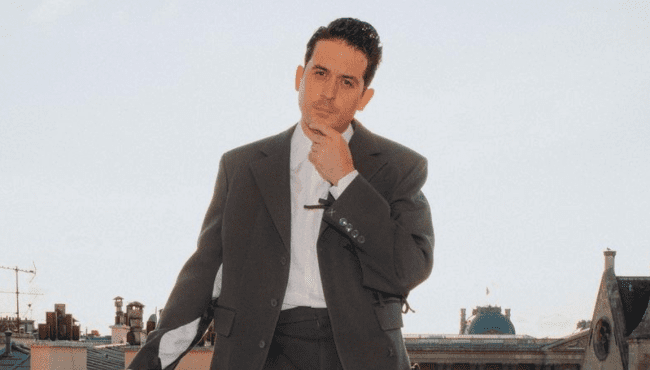

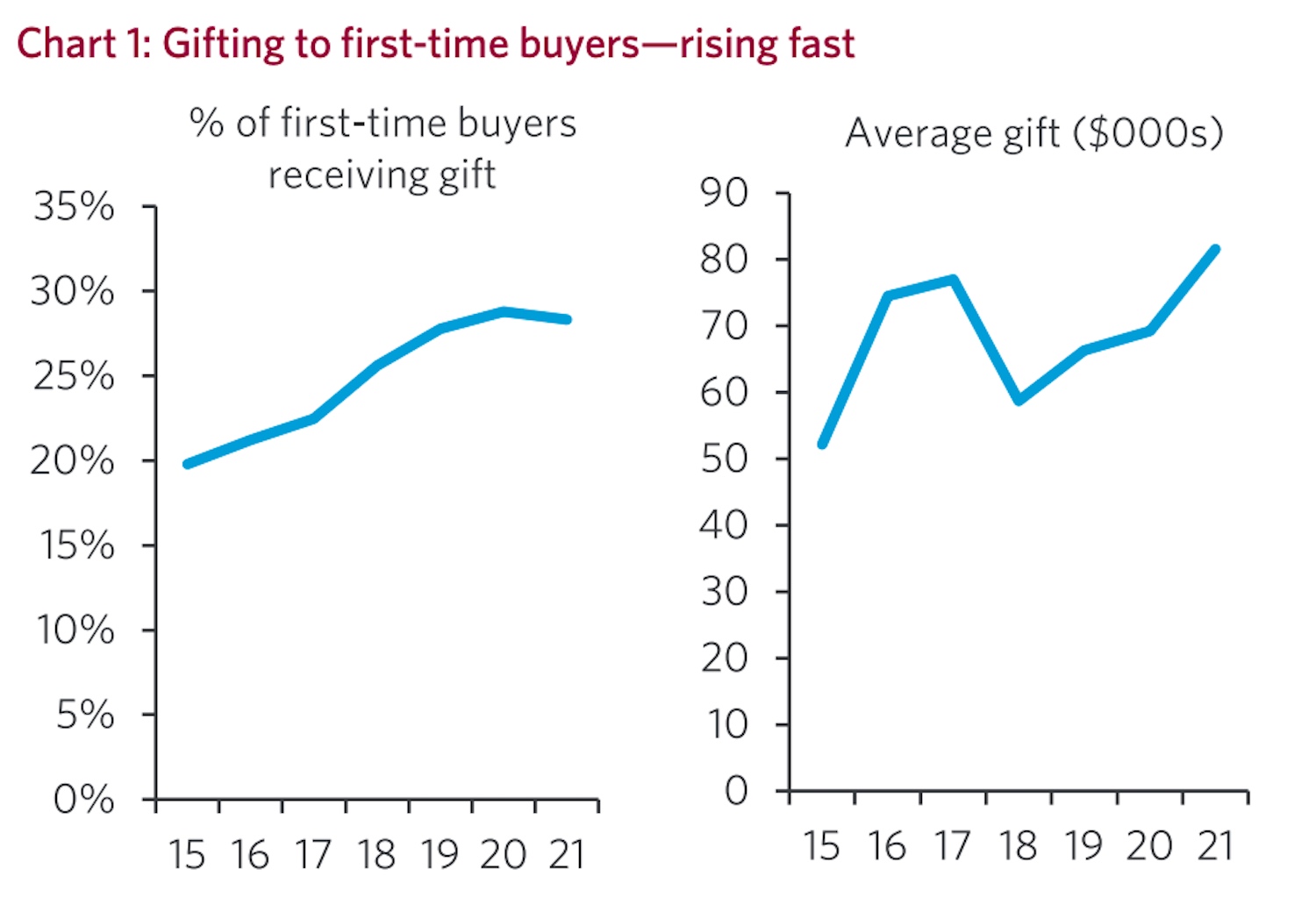

While some home buyers receiving gifts from their parents to help with a down payment is nothing new, things reached new highs last year. In 2020, just under 30% of buyers in Canada received gifts from their parents to help with a down payment, up from 20% in 2015. The average amount of money gifted has risen significantly, from $52,000 in 2015 to $82,000 in 2020. As you can probably guess, the size of the gift closely tracks housing prices across Canada (see below).

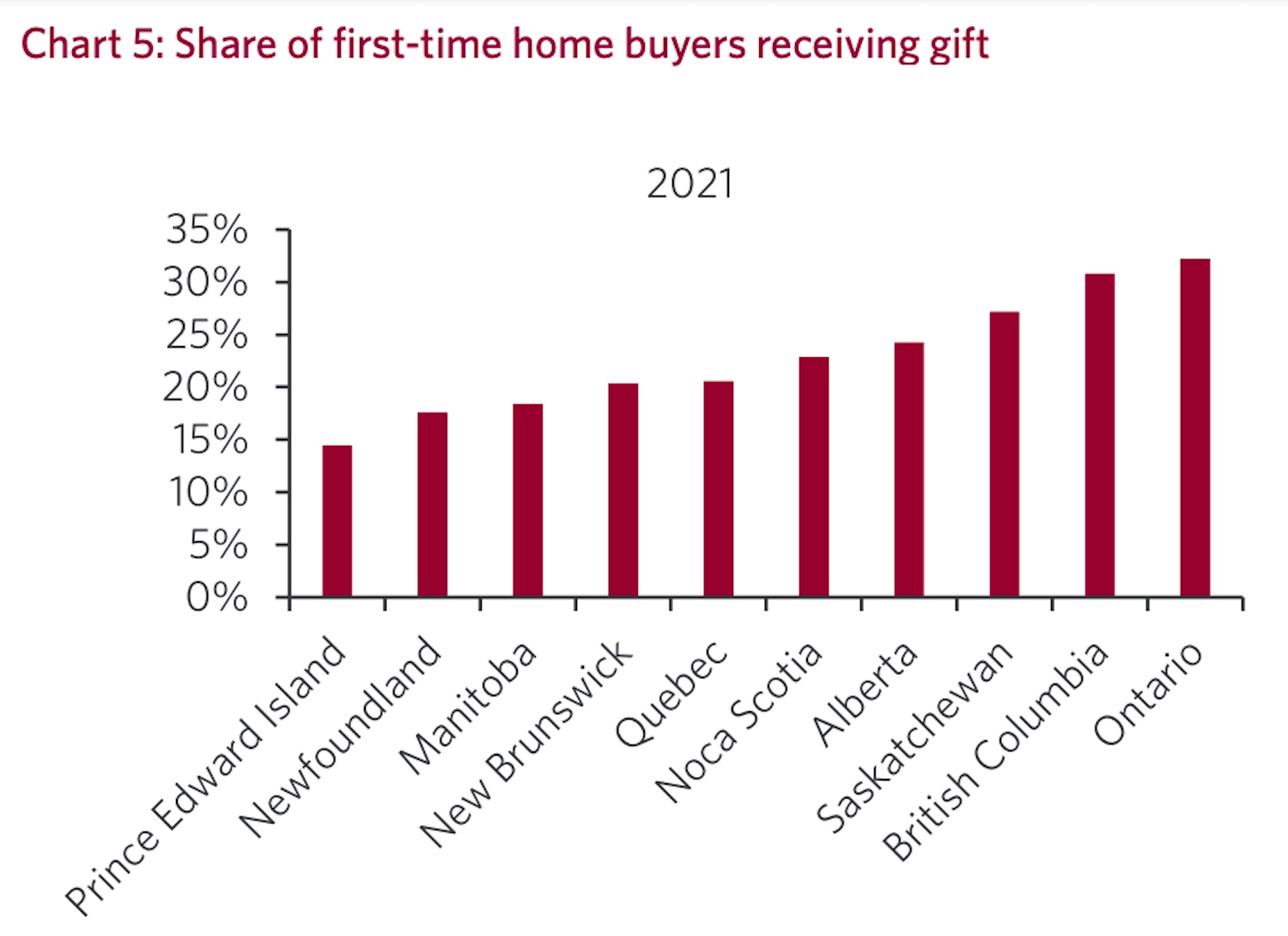

The gifts also vary significantly, based on where they’re being given. For some truly crazy numbers, the average size of a ‘gift’ in Toronto was an astonishing $130,000. Vancouver was even higher, at $180,000. Fun fact- these cities also had the highest rate of parents using credit (like using their own home’s equity) to give the gift, at around 9% and 14%, respectively.

Add it up across the country, and an estimated $10B was gifted last year in Canada. For reference, that accounts for roughly 10% of down payments as a whole in Canada for 2020.

Ok, so those are the facts, and now it’s time for us to spitball a bit. We think that an increasing number of parents are opting into ‘inter vivos‘ plans, providing their children with the capital needed to get the same privileges they had growing up. In decades past, a solid (and maybe private) education was usually enough to all but ensure an upper-middle-class life for the receiver (aka the child) and the benefits (home, multiple vehicles, etc…) it comes with.

Millennials, quit whining. I paid off $150,000 in student loans and own a $400,000 home, because I SAVE. It’s not that hard. I

-Make coffee at home

-Bus instead of Uber

-Shop sales

-Had parents pay off my loans & buy me a house because I’m daddy’s special boy

-Got Hulu with ads— Andrew Nadeau (@TheAndrewNadeau) October 21, 2019

These days, you can possess a university degree and still be struggling to make as much as someone who works at Costco, while the truly wealthy reap the rewards of passive income like dividends and interest payments. These macro changes have continuously eroded the ‘middle class’, with the added effect of increasing the wealth gap in Canada and beyond.

Just something to keep in mind the next time a random person says that wealth taxes are a silly idea.