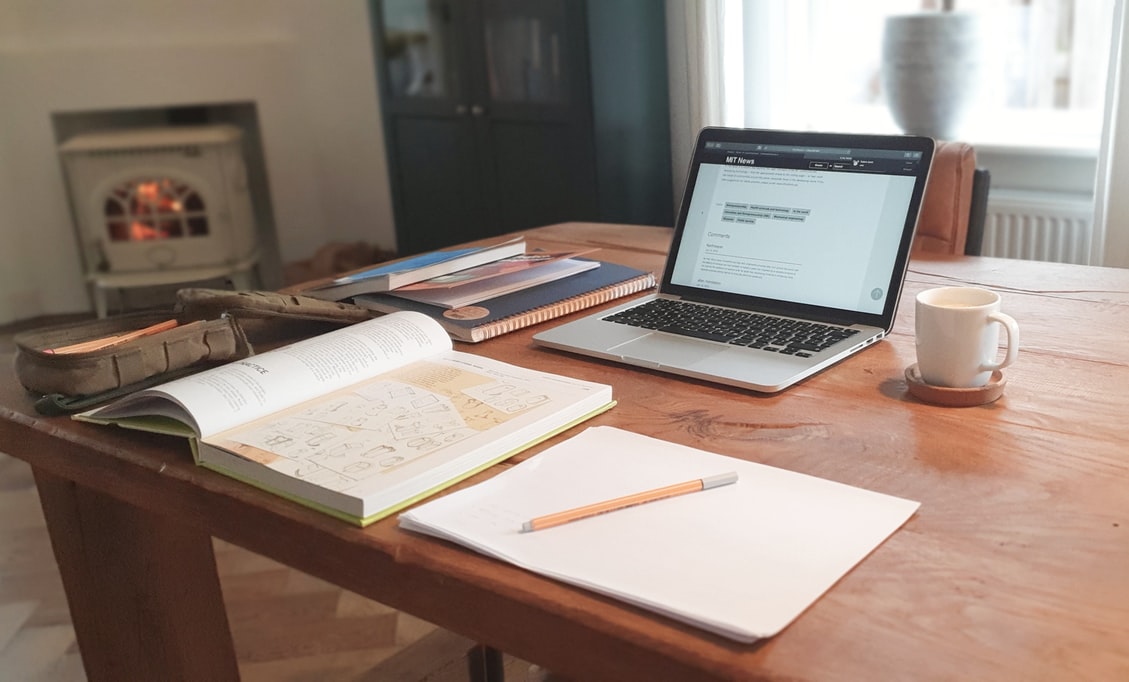

2020 was the year of working from home. Or was it the year of living at work? We’ll let you be the judge of that. If you’re one of the many Canadians whose living room became a home office last year, you could be eligible for an income tax deduction. The Canadian Revenue Agency (CRA) just simplified the process to receive this nifty deduction.

For starters, you have to fall into a few categories to be eligible. First, you worked from home due to the COVID-19 pandemic or your employer required you to work from home. Second, you worked more than 50% of the time from home for a period of at least four consecutive weeks. And third, the expenses you’re claiming were used directly in your work during this person. If that sounds like you, keep on reading!

Recent Posts:

The Schitt’s Creek mansion that the Rose Family lost is for sale in Toronto for $15 million

This low-cal, craft non-alcoholic beer is the perfect pairing for The Big Game

The income tax deduction could help cover things like an increased utility bill because you’re using more electricity while at home. Or home internet service fees, because let’s be real, we all live online now. You can even claim rent paid for a house or apartment where you live. For a full breakdown of all this, head online here.

Even better, this year has a temporary work-from-home flat rate of $2 per day for up to 200 work from home days. That means right off the bat you could be eligible for $400 bucks back. Not bad at all!

So there you have it! Hopefully, this income tax deduction will help out all you work-from-homers. If you’d like to learn more, you can read all about it here.JTNDZGl2JTIwaWQlM0QlMjJtb2JpbGUtYWQtb25seSUyMiUzRSUwQSUzQyUyMS0tJTIwVG9yb250byUyMC0lMjBNb2JpbGUlMjAtLSUzRSUwQSUzQ2lucyUyMGNsYXNzJTNEJTIyYWRzYnlnb29nbGUlMjIlMEElQzIlQTAlQzIlQTAlQzIlQTAlQzIlQTAlQzIlQTBzdHlsZSUzRCUyMmRpc3BsYXklM0FibG9jayUzQndpZHRoJTNBMzIwcHglM0JoZWlnaHQlM0E1MHB4JTNCJTIyJTBBJUMyJUEwJUMyJUEwJUMyJUEwJUMyJUEwJUMyJUEwZGF0YS1hZC1jbGllbnQlM0QlMjJjYS1wdWItNTUyMTg1Njk1NTQ5NzQ1NiUyMiUwQSVDMiVBMCVDMiVBMCVDMiVBMCVDMiVBMCVDMiVBMGRhdGEtYWQtc2xvdCUzRCUyMjEyMTk1NjU4MzQlMjIlM0UlM0MlMkZpbnMlM0UlMEElM0MlMkZkaXYlM0U=