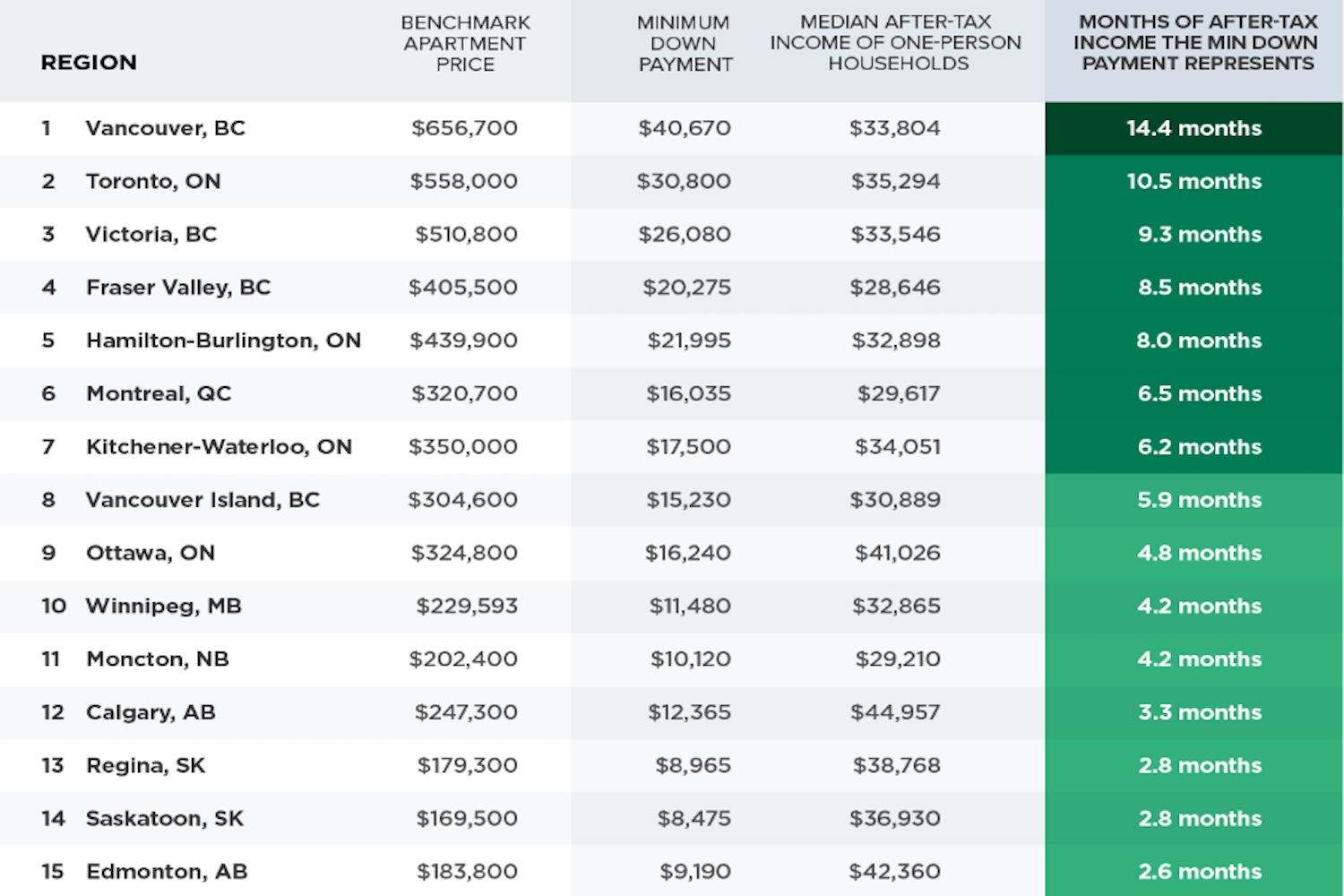

Fun fact- did you know that between 1981 and 2016, the number of people living alone in Canada doubled? The country is trending towards solo living, which means you might be trying to buy an apartment in Toronto by yourself. So, the real estate firm Zoocasa decided to take a peek at what it takes to do so across the country. Surprise! Toronto is not good.

Let’s start at the most affordable city, Edmonton. Although the down payment ($9,190) cost is slightly higher than the cheapest city, Saskatoon ($8,475), the median income in Edmonton ($42,360) outweighs that of Saskatoon. So, Edmonton home buyers would have to save their entire earnings for 2.6 months to afford a down payment.

Related posts:

2020 Cost of Living Index reveals annual price tag of living in Toronto

A Friends-themed brunch is coming to Toronto

Ok, so that’s the most affordable, but we’re sure you’re interested in Toronto’s stats. Well, with a benchmark apartment price around $558k, we need to come up with around $31k in order to solidify a down payment. Also, the median income in Toronto is just over $35k.

Time for some quick maths. If you set aside all your earnings to save up, it would still take roughly 10.5 months to be able to afford a down payment for a Toronto apartment. Yikes. And that’s setting aside 100% of your income, which obviously isn’t how life works. Even if you were balling enough to set aside half of your money, you’d be looking at almost two years of saving.

If you’re ready for something even crazier, then you should check out the annual price tag of living in Toronto right here.